Offshore Company Formation: Trick Approaches to Increase Your Organization

Offshore Company Formation: Trick Approaches to Increase Your Organization

Blog Article

Vital Do's and Do n'ts of Offshore Firm Development

Establishing an overseas company can be a calculated move for several businesses looking for to expand their operations globally or enhance their tax liabilities. The procedure of offshore company development needs cautious factor to consider and adherence to important guidelines to make certain success and conformity with the regulation.

Choosing the Right Jurisdiction

Selecting the proper jurisdiction is an essential decision when establishing an overseas business, as it straight affects the legal, monetary, and functional facets of the organization. It is necessary to think about aspects such as political security, track record, simplicity of doing organization, and lawful system efficiency when selecting a jurisdiction for an offshore firm.

In addition, the selected territory ought to align with the business's functional demands and particular goals. Carrying out comprehensive research and seeking expert guidance can assist browse the complexities of choosing the best jurisdiction for an overseas business.

Recognizing Tax Obligation Ramifications

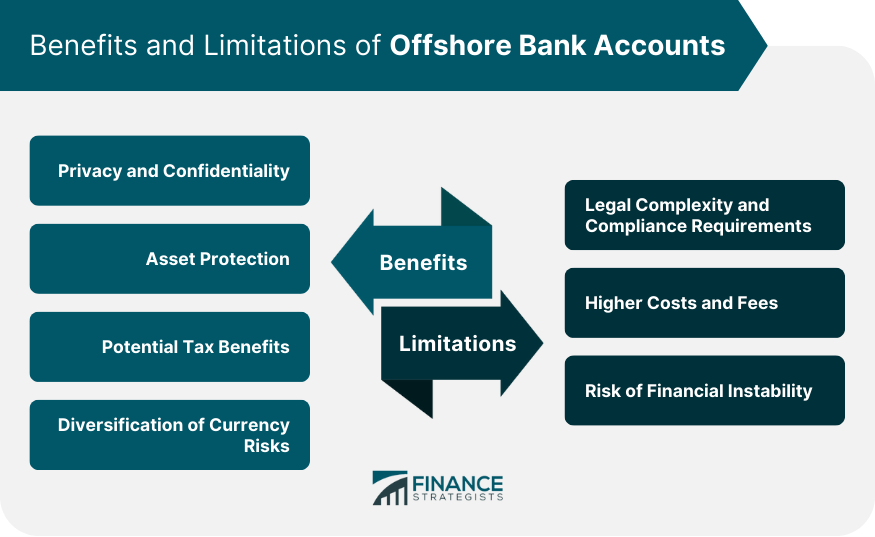

An essential element to consider when developing an offshore business is understanding the tax obligation ramifications associated with the picked jurisdiction. Various offshore jurisdictions provide differing tax structures, including business tax obligation rates, VAT, and various other levies that can considerably influence the total profitability of your offshore endeavor. It is important to carry out extensive research or look for professional guidance to recognize just how these tax obligation regulations will influence your service procedures.

One vital aspect to consider is the tax residency rules in the picked jurisdiction. Understanding whether your offshore company will be thought about tax homeowner in that nation can figure out the extent of tax commitments you will certainly have to fulfill. Furthermore, familiarize yourself with any kind of tax motivations or exceptions that might be available for overseas firms in the picked territory.

Compliance With Laws

When developing an overseas company to keep legal compliance and mitigate possible dangers,Making sure adherence to regulatory needs is vital. Offshore territories have varying laws worrying company formation, procedure, reporting, and tax. It is essential to extensively research study and recognize the particular regulative landscape of the chosen territory before waging the formation process

One key element of conformity is the due persistance demands imposed by regulatory authorities. These demands frequently mandate the collection and verification of extensive documentation to confirm the legitimacy of the service and its stakeholders. Failure to meet these due diligence requirements can lead to extreme charges, consisting of penalties, permit cancellation, or perhaps criminal fees.

Moreover, staying abreast of any kind of governing adjustments or updates is crucial for recurring conformity. Consistently examining and upgrading interior plans and procedures to line up with existing policies can aid avoid non-compliance issues. Seeking expert support from legal and economic specialists with knowledge in offshore policies can likewise help in browsing the complicated conformity landscape. By prioritizing governing conformity, offshore firms can run with confidence and stability.

Hiring Local Specialists

When developing an overseas company, engaging neighborhood specialists can substantially improve the efficiency and efficiency of the formation procedure. Regional professionals have invaluable understanding of the governing framework, cultural subtleties, and company methods in the jurisdiction where the offshore firm is being set up. This knowledge can enhance the unification process, making certain that all lawful needs are met precisely and expediently.

Hiring regional specialists such as legal representatives, accountants, or organization professionals can additionally offer accessibility to a network of contacts within the local business community. These connections can help with smoother communications with regulative authorities, banks, and various other important provider. In addition, neighborhood professionals can provide understandings right into market patterns, possible chances, and challenges details to the overseas jurisdiction, assisting the business make informed calculated choices from the outset.

Preventing Illegal Activities

To maintain conformity with legal guidelines and promote moral standards, alertness against engaging in immoral methods is extremely important when establishing an overseas firm - offshore company formation. Engaging in prohibited activities can have severe consequences, including large fines, lawful repercussions, damages to track record, and potential closure of the overseas company. It is crucial to perform comprehensive due persistance on the legislations and guidelines of the jurisdiction where the offshore firm is being established to make certain full compliance

Furthermore, staying informed regarding regulatory adjustments and seeking lawful advice when needed can additionally protect the overseas company from inadvertently obtaining included in click here for more info unlawful methods. By focusing on lawful compliance and ethical behavior, overseas firms can operate successfully within the confines of the law.

Conclusion

It is crucial to consider elements such as political stability, online reputation, convenience of doing company, and legal system efficiency when picking a territory for an overseas firm.

A vital facet to think about when establishing an offshore Get More Info company is understanding the tax obligation ramifications included in the picked territory. In addition, acquaint on your own with any type of tax obligation rewards or exemptions that may be offered for offshore business in the chosen jurisdiction.

It is essential to carry out extensive due diligence on the regulations and guidelines of the territory where the overseas business is being established to guarantee full conformity.

In Click This Link verdict, adherence to lawful regulations, comprehending tax ramifications, and choosing the proper territory are crucial factors in overseas firm formation. - offshore company formation

Report this page